Our work as forensic economists in wrongful death and personal injury cases involves calculating the present value of loss of income and life care costs.

In our article “Critical Features of a Forensic Economist’s Report,” we outline three key elements in one of our reports.

Let’s take the example of a personal injury case. That is, the plaintiff is still alive. We call this type of case a “personal injury” one to distinguish it from a “wrongful death” case where the plaintiff has died.

Element 1 (Internal)

Basically, we develop two scenarios. Here we focus on what the plaintiff would have earned “but-for” an injury.

We refer to this as “business as usual.” (Element 1).

We must consider several factors to project what earnings would have been without injury. For example, we must determine whether to use the loss of earnings or earnings capacity.

Element 2 (Internal)

The other scenario is what the plaintiff will earn “given” the injury.

We refer to this as the “post-event future income stream.” (Element 2).

As in Scenario 1, we must consider several factors that might limit the plaintiff’s ability to earn. For example, one consideration is how the physical injury affects post-event earnings.

We calculate the losses by taking the difference between pre-event and post-event income. The difference between the two scenarios constitutes economic or monetary damages.

Element 3 (Extternal)

In Elements 1 and 2, we determine what the losses will be in the future. The last step is to calculate the amount the plaintiff should receive today.

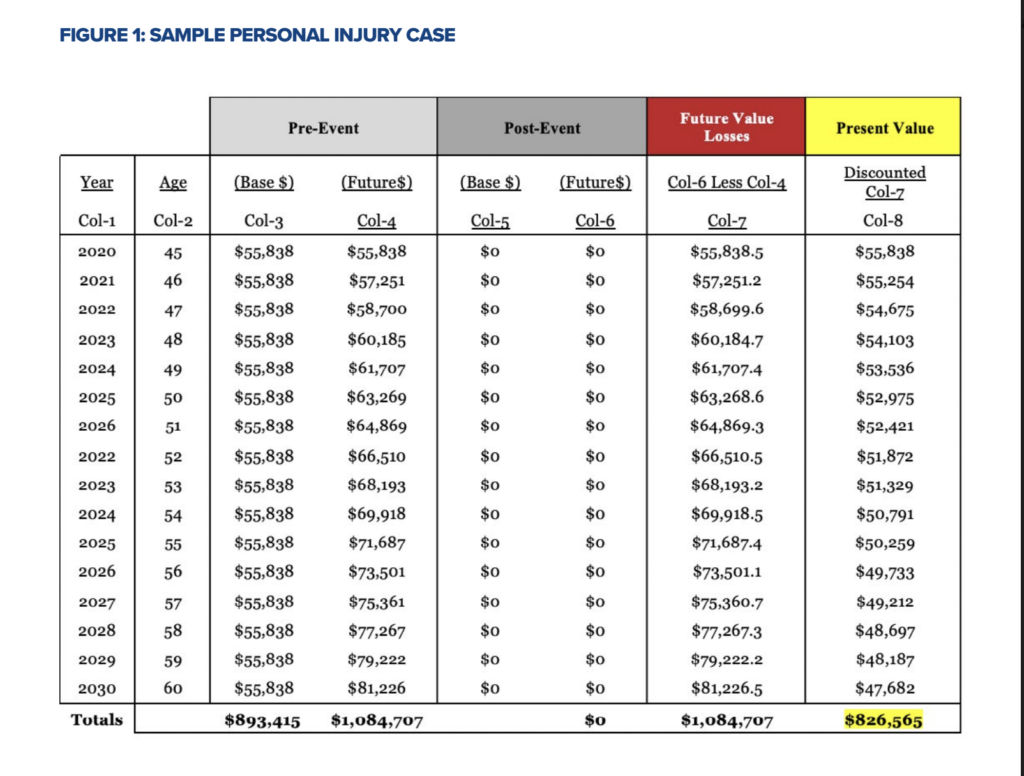

In Figure 1 of the article, we illustrate in Column 7 the future value of the losses. We estimate these values based on the rate of growth in earnings, we assume.

Column 8 shows how much the plaintiff should be awarded today at an assumed interest rate.

The interest rate is what the plaintiff invested their award at the prevailing interest rate, and they withdrew a portion each year, according to Figure 1.

In the example (Figure 1), the future monetary value of losses is $1,084,707. The present value is $826,565. The difference between the future and present value is the amount of interest the plaintiff would earn if they treated their award as a series of periodic payments.

Disputes between plaintiff and defense experts about growth and discount rates abound in our work. Why? The higher the interest rate, the lower the present value, and the lower the interest rate, the higher the present value.

There are variations in Elements 1 and 2 if the case is a wrongful death rather than a personal injury one, but the “critical features” remain the same.