Elon Musk’s proposed acquisition of Twitter has increased our familiarity with the concept EBITDA and what it means for valuing a business. That is in determining what a business is worth or what we should pay for it.

EBITDA stands for earnings before, interest, taxes, depreciation, and amortization. We subtract from the total revenues the firm’s operating expenses and maybe some other adjustments to get EBITDA.

EBITDA is the amount of cash available to develop the business.

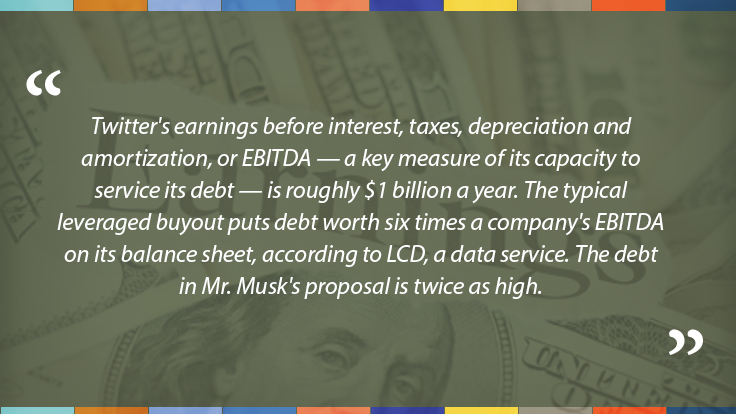

A New York Times article asks, “Can Elon Musk Make Twitter’s Numbers Work?” (April 30, 2002). The journalists Anupeeta Das and Lauren Hirsch note the following:

Our articles and presentations encourage gig and other self-employed workers to know their EBITDA.

Why?

They need to think beyond “net profit?”

Why?

Net profit is just one way to think about the benefit they get from their business. The regulatory and tax authorities determine interest, depreciation, and amortization. However, these factors affect how much someone pays in taxes, and they pay these to the government. They say nothing about the amount of “cash” the business generates to invest in its future.

Net profit looks back. It’s an essential measure of what has happened in the past. However, when we’re valuing a business, we must look forward. So, we must ask the question: What’s the future value of the business? EBITDA is one answer.

One debate about Musk’s acquisition of Twitter is whether the company will generate enough cash (EBITDA) in the future to cover today’s acquisition costs and provide a return on investment. Lenders will want their money back (principal and interest). Equity investors will want a return. Some argue Musk is overpaying.

We can use EBITDA for things other than debt servicing. It provides cash to run the business and invest in its expansion. We highlight in several of our forensic economic reports that the loss of EBITDA is one way to measure economic damages.

Musk can increase Twitter’s EBITDA.

How?

He can reduce costs or increase revenues.

All business owners have these tools.

For Musk, this most likely will mean laying off workers or increasing their productivity. On the other hand, he may increase revenues by changing the advertising rate structure or charging a fee. At a minimum, he’ll have to keep advertisers and users from fleeing the platform.

In other words, Musk will have to rethink Twitter’s business model.

He must apply “The Musk Magic” and demonstrate what he sees that we may not.

We’re not here to opine on the Twitter deal.

What we’re excited about is that everyone is talking about EBITDA.

Such talk should encourage every business owner to know their EBITDA and how they can increase it. They should also consider whether they should be rethinking their business model before someone else does.